All Categories

Featured

Table of Contents

That generally makes them a more affordable option for life insurance protection. Many people obtain life insurance coverage to assist financially protect their liked ones in situation of their unanticipated fatality.

Or you may have the alternative to transform your existing term coverage into a permanent policy that lasts the rest of your life. Different life insurance policies have potential benefits and drawbacks, so it is very important to comprehend each before you choose to acquire a policy. There are numerous advantages of term life insurance policy, making it a preferred selection for protection.

As long as you pay the premium, your recipients will obtain the fatality advantage if you pass away while covered. That claimed, it is essential to keep in mind that a lot of policies are contestable for two years which implies protection might be rescinded on fatality, must a misrepresentation be discovered in the app. Policies that are not contestable commonly have actually a rated death benefit.

What Exactly is Guaranteed Level Term Life Insurance?

Premiums are generally less than whole life policies. With a level term policy, you can choose your coverage amount and the plan length. You're not secured right into an agreement for the remainder of your life. Throughout your plan, you never ever need to stress over the premium or fatality advantage quantities changing.

And you can not cash out your policy during its term, so you won't receive any financial take advantage of your past coverage. Similar to various other kinds of life insurance policy, the expense of a level term policy depends upon your age, coverage requirements, employment, way of living and health and wellness. Typically, you'll find much more inexpensive insurance coverage if you're more youthful, healthier and less dangerous to insure.

Since level term premiums stay the same for the duration of coverage, you'll recognize specifically how much you'll pay each time. Degree term protection additionally has some flexibility, enabling you to tailor your policy with extra features.

What is Term Life Insurance With Accidental Death Benefit? Detailed Insights?

You may have to meet certain problems and credentials for your insurance firm to establish this motorcyclist. There likewise might be an age or time restriction on the insurance coverage.

The survivor benefit is generally smaller sized, and protection normally lasts till your child transforms 18 or 25. This cyclist may be a more cost-efficient means to help guarantee your kids are covered as cyclists can usually cover several dependents simultaneously. Once your child ages out of this coverage, it may be possible to transform the motorcyclist into a brand-new plan.

When comparing term versus irreversible life insurance policy, it is essential to remember there are a few different types. One of the most usual sort of long-term life insurance policy is entire life insurance coverage, yet it has some crucial differences contrasted to level term protection. Term life insurance level term. Right here's a standard review of what to take into consideration when comparing term vs.

Whole life insurance policy lasts forever, while term insurance coverage lasts for a specific period. The costs for term life insurance policy are typically less than entire life insurance coverage. However, with both, the costs remain the exact same throughout of the plan. Entire life insurance policy has a cash value component, where a section of the premium might expand tax-deferred for future needs.

One of the highlights of degree term insurance coverage is that your premiums and your survivor benefit do not change. With reducing term life insurance policy, your costs continue to be the exact same; nevertheless, the survivor benefit amount gets smaller gradually. As an example, you might have coverage that begins with a survivor benefit of $10,000, which might cover a mortgage, and after that annually, the survivor benefit will reduce by a collection amount or portion.

As a result of this, it's often an extra budget friendly sort of degree term insurance coverage. You might have life insurance coverage through your company, yet it may not suffice life insurance policy for your needs. The very first step when buying a plan is establishing just how much life insurance policy you need. Consider aspects such as: Age Family members dimension and ages Work condition Earnings Debt Way of living Expected last expenditures A life insurance calculator can aid figure out just how much you require to start.

Term Life Insurance With Level Premiums Explained

After making a decision on a policy, complete the application. If you're authorized, sign the paperwork and pay your initial premium.

You might want to update your beneficiary information if you have actually had any significant life adjustments, such as a marriage, birth or divorce. Life insurance policy can occasionally feel complex.

No, level term life insurance policy does not have cash value. Some life insurance policy plans have a financial investment feature that permits you to build cash money value gradually. A section of your costs repayments is reserved and can earn rate of interest in time, which grows tax-deferred throughout the life of your coverage.

However, these plans are often substantially more expensive than term coverage. If you get to completion of your plan and are still to life, the coverage ends. You have some choices if you still want some life insurance protection. You can: If you're 65 and your protection has actually run out, for instance, you may intend to acquire a new 10-year degree term life insurance plan.

What is Level Term Life Insurance Definition? Important Insights?

You might have the ability to convert your term insurance coverage into a whole life policy that will last for the remainder of your life. Numerous sorts of degree term policies are convertible. That indicates, at the end of your insurance coverage, you can transform some or all of your plan to entire life coverage.

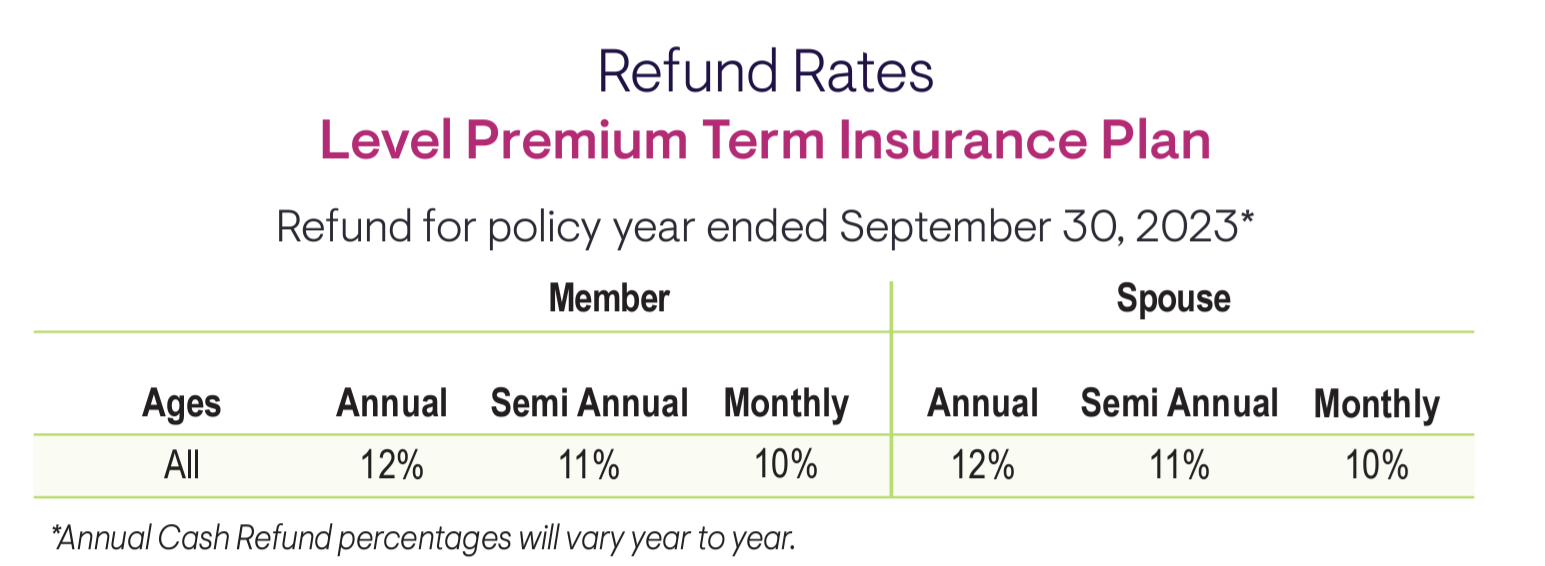

A level premium term life insurance policy plan allows you stick to your budget plan while you aid protect your family members. Unlike some stepped price plans that raises every year with your age, this type of term plan uses rates that remain the same through you choose, also as you obtain older or your health modifications.

Find out more about the Life Insurance options available to you as an AICPA member (Term life insurance for couples). ___ Aon Insurance Coverage Providers is the brand name for the brokerage firm and program management operations of Affinity Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Policy Providers Inc.; in CA, Aon Fondness Insurance Policy Solutions, Inc .

Table of Contents

Latest Posts

Funeral Expense Insurance For Seniors

Funeral Cover Companies

Funeral Plan Quote

More

Latest Posts

Funeral Expense Insurance For Seniors

Funeral Cover Companies

Funeral Plan Quote